You Might Own Nothing Sooner Than You Think

By Aaron Day

By Aaron Day

Imagine a world where ownership is a distant memory, replaced by an eerie semblance of joy in dispossession. In 2016, Klaus Schwab, the enigmatic architect of the World Economic Forum, foretold a future whereby, in 2024, humanity would be stripped of its possessions, shackled in digital chains, yet deceived into a state of contentment. Initially dismissed as lunacy, we stand on the precipice of this harrowing reality; Schwab’s vision looms ominously over us, more prophetic than we dared to believe.

For decades, a clandestine cabal of technocrats has meticulously orchestrated our descent into digital serfdom. We sleepwalked into their trap and surrendered our rights and possessions to those who wield the power of the keystroke. In this brave new world, ownership is an illusion, and with a mere digital command, everything we hold dear can be seized.

This article unveils the sinister agenda behind the facade of progress. It explores the erosion of ownership through clickwrap agreements, the dematerialization of our assets into databases over the past few decades, the rise of Central Bank Digital Currencies (CBDCs), which threatens our control over money, and The Great Taking, which threatens our control over the rest of our non-monetary assets.

All is not lost, although, in a separate article, I will address that our salvation comes not at the ballot box but through our radical non-compliance. Technology can either be used to promote freedom or tyranny. I will discuss how we can adopt technologies to counter the digital slave system actively being developed by technocrats, thus guaranteeing our privacy, ability to engage in voluntary trade, and retention of our free will.

The Erosion of Ownership: A Descent into Digital Serfdom

In the bleak dawn of the digital age, we find ourselves trapped in a labyrinth of click-wrap agreements; our freedoms quietly surrendered to the whims of faceless corporations. The once-mighty notion of personal ownership has been reduced to a mere abstraction, a quaint relic of a bygone era.

As we click “I agree” with reckless abandon, we seal our fate, surrendering our autonomy to the technocrats who manipulate and control us through the devices we thought would liberate us. Once hailed as a bastion of freedom and progress, the digital realm has devolved into a dystopian nightmare where our every move is tracked, monitored, and exploited.

The Insidious Nature of Digital Control

We are lulled into complacency by the convenience and ease of digital transactions, unaware of the subtle yet pervasive manipulation that underlies every click, every swipe, and every tap. The fine print, a behemoth of legalese, conceals the true nature of our agreements, hiding in plain sight the draconian terms that govern our digital existence.

Consider the staggering numbers: we encounter an estimated 150-400 click-wrap agreements per year, each a ticking time bomb of obligations and responsibilities that we blithely accept without a second thought. These agreements are ubiquitous, embedded in every aspect of our digital lives:

- Software licenses, like Microsoft’s 70-page End User License Agreement (EULA)

- Online shopping agreements, like Amazon’s 12,000-word Conditions of Use

- Social media terms of service, like Facebook’s 25-page Statement of Rights and Responsibilities

- Mobile app agreements, like Apple’s 50-page iOS Software License Agreement

- Online banking agreements, like Wells Fargo’s 30-page Online Access Agreement

A Life Sentence of Reading

To keep up with the fine print, we would have to devote up to an hour every day, 365 days a year, just to read the agreements. This is the actual cost of our digital existence: a life sentence of reading, a never-ending task that would consume a significant portion of our daily lives.

A Study in Deception

A recent experiment revealed the shocking truth: 74% of participants blindly accepted terms that would have surrendered their firstborn children to the service’s owners and provided their personal information to the NSA. As one researcher noted:

The results are a stark reminder of the power of the ‘clickwrap’ – the ability to get people to agree to anything, no matter how outlandish, as long as it’s buried in a long and complex contract.

– Dr. Jonathan Obar, York University

The Stage is Set for Asset Transfer

Our increased participation with these clickwrap agreements has set the stage for our assets to be transferred at the click of a button. With the rise of digital currencies, online marketplaces, and social media platforms, our financial, personal, and creative assets are more vulnerable than ever. The implications are dire: a future where our assets are seized, frozen, or transferred without our consent, all under the guise of “agreements” we never truly understood.

We have unwittingly surrendered our autonomy, creativity, and humanity to the whims of corporate overlords. As you will see in the coming sections, the assignment of our rights through digital agreements, CBDCs, and asset tokenization will soon leave us owning nothing.

Because this article is long, I will keep a cumulative list of key takeaways as bullet points at the end of each section.

Key takeaways:

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

The Digitized Domain: A House of Cards Built on Fragile Databases and Corrupt Intermediaries

The digitization of our lives has bestowed upon us a double-edged sword: convenience and vulnerability. We’ve traded the tangible for the intangible, surrendering our assets to the capricious whims of databases and their intermediaries. But let’s be clear: databases are not just peripheral components of our digital lives but the foundation of modern commerce.

Consider it: corporations and governments store every transaction, asset, and record of ownership in a database. Your car title, house deed, and even the shares you hold in a company are all reduced to mere data points within these centralized repositories. And yet, we’re asked to trust that these systems will safeguard our investments and identities from prying eyes and malicious actors.

But here’s the thing: most of our assets have already been digitized. They exist only as entries in a database, and their value is entirely dependent on the integrity of that database. If the database is compromised, the asset is compromised. If the database is destroyed, the asset is destroyed. Database corruption is not just a theoretical risk; it’s a very real one. The financial losses alone are staggering—$1 trillion in 2017, a projected $10.5 trillion by 2025.

And what of the human cost? The disruption of lives, the theft of identities, the destruction of trust? The intermediaries who manage these databases – governments, corporations, and financial institutions – have become gatekeepers to our assets, wielding influence over markets and shaping economies. And yet, we’re expected to accept their security and stability assurances blindly.

Let’s take a step back and consider the current state of affairs. The labyrinthine transaction process, as we know it today, is a veritable goldmine for the parasites and leeches that thrive in its shadows. Third-party intermediaries—lawyers, brokers, or bureaucrats—add layer upon layer of time, money, and expense to every transaction, like a suffocating ivy strangling the life out of a tree. Just as the ivy’s tendrils wrap around the tree’s trunk, squeezing out its vitality, these intermediaries choke the life out of our transactions, draining them of efficiency, transparency, and fairness.

Consider this: according to some estimates, these parasitic middlemen gobbled up as much as 30-40% of the revenue in specific industries. That’s right, nearly half of every dollar you spend can vanish into the abyss of unnecessary costs and inefficiencies before it even reaches the hands that produce the goods or services we desire.

And what do we get in return for this fleecing? A system riddled with redundancies, opacity, and corruption. This concern isn’t new. You can read all about it in the pages of The Wealth of Nations by Adam Smith, who warned against the evils of middlemen and monopolies over two centuries ago.

People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.

– Adam Smith

Whether we like databases being at the heart of commerce or not, they aren’t going away. A new trend is emerging: tokenization, which converts assets into unique digital tokens that can be stored and traded on digital ledgers. Tokenization means a digital token will eventually represent everything from property to goods to services. As we’ll explore in future sections, this shift towards tokenization can either fix some of the security problems and inefficiencies associated with middlemen or create a new level of tyranny. With tokenization, we may be able to create a new, decentralized system for managing our assets and transactions or further surrender our control of our assets to the globalist cabal.

Key takeaways:

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

- Our assets and transactions, now digitized and stored in fragile databases managed by corrupt intermediaries, are vulnerable to loss, theft, and manipulation, highlighting the risks and inefficiencies of our current digital system.

The Money in Our Bank Accounts Doesn’t Belong to Us

We’ve come to understand that we’ve been signing away our rights digitally, surrendering control over our lives to the whims of centralized databases and their intermediaries. But the loss of ownership doesn’t stop there – it permeates every aspect of our existence, from our cars and houses to our money.

Let’s start with what should be our most basic financial instrument: the bank account. We consider the money in our bank accounts ours, but a closer look reveals a different reality. Through my research on the terms and conditions of the four largest banks – Bank of America, Chase, Wells Fargo, and Citibank – I’ve discovered that they can cancel the account without cause, sell or give away our data (and they do give our transaction info to the IRS for use with AI to make sure the taxman gets his cut), change fees, and even modify the terms and conditions at will. I encourage you to check the terms and conditions of your bank account.

These contractual terms mean that the money in our bank accounts doesn’t belong to us. It’s held in trust by these financial institutions, subject to their whims and control. And with digital transactions comprising the majority of economic activity—a staggering $3 trillion as of 2023—it’s clear that our money is already primarily digitized.

The insidious tendrils of centralization have trapped us all, from the high and mighty to the lowly and obscure. It’s a web of control extending far beyond mere money – it’s a stranglehold on our lives.

Consider the cases of Nigel Farage, Dr. Joseph Mercola, and his family – their bank accounts were summarily closed without explanation or provocation. And who’s next? Kanye West, Nick Fuentes, gun groups, religious associations, professional unions, and even protesting truckers – all targeted for exercising their rights, all silenced by the banks.

At this point, we aren’t even talking about CBDCs. When people bleat about CBDCs today, they mostly talk about getting their money shut off or being monitored. That already happens today. The threat isn’t the CBDCs of tomorrow but the current state of the dollar today.

CBDCs simply take this surveillance and programmability to the next level – paving the way for complete digital tyranny.

An Introduction to Tokenization

But what if there was a way to break free from the shackles of these intermediaries and their centralized databases? A way to reclaim ownership and control over our assets, to strip away the layers of unnecessary costs and inefficiencies that plague our transactions? Enter the world of digital tokens.

A digital token is a unique digital identifier representing something of value, like a coin or a piece of property. Unlike traditional databases, where information is stored in a single, centralized location, digital tokens are decentralized, meaning they exist independently on a network of computers. Tokenization allows for peer-to-peer transactions without needing a middleman or relying on a single, vulnerable database. Digital tokens can create a more secure, transparent, and efficient system for exchanging value.

However, not all tokens are created equally. These tokens could promote freedom, decentralization, or free trade or be used as a surveillance mechanism that leads to confiscating our assets.

The following is a high-level overview of token types, followed by an overview of the massive range of uses for tokenization. In subsequent sections, we will go through specific examples of tokenization and highlight the dimensions of freedom versus tyranny.

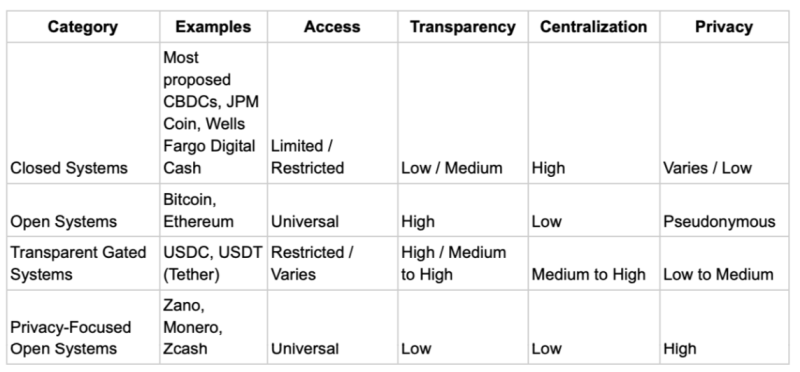

- Open Systems: These systems are fully transparent and accessible to all. There are no gatekeepers; anyone can participate or observe without permission.

- Transparent Gated Systems: While anyone can view the system’s activities, participation is restricted to approved entities.

- Closed Systems: These systems are restricted in both access and visibility. Only authorized parties can participate and view information.

- Privacy-Focused Open Systems: These systems allow open participation but obscure the details of individual activities.

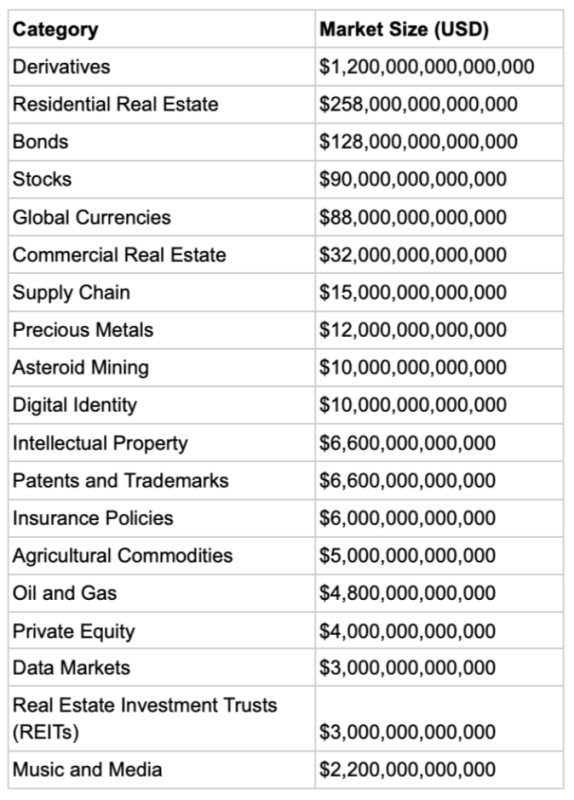

Considering all of this, we’re witnessing the dawn of a new era in finance, where the tokenization of assets has unleashed a staggering $1.5 quadrillion+ market (yes, you read that right). But it’s not just the impressive size—the breathtaking breadth of possibilities that’s truly revolutionary.

Imagine being able to buy, sell, and trade anything of value, from the most minor, most personal items to the most significant, most complex assets. Tokenization is making this a reality. For instance, a rare, vintage car can be tokenized and sold to a collector, while a massive renewable energy project can be tokenized and traded on a global market.

A small, independent filmmaker can tokenize their latest movie and sell it directly to viewers, cutting out intermediaries and retaining creative control. Meanwhile, a multinational manufacturer can tokenize its inventory, optimize logistics, and streamline operations.

A local, community-supported farm can tokenize its weekly harvest, allowing customers to pre-order and pay for their favorite produce in advance. At the same time, a global e-commerce platform can tokenize entire shipping containers, facilitating international trade and reducing transaction costs.

The possibilities for tokenization are vast, from intellectual property rights to sustainable forestry credits, from virtual event tickets to rare, collectible books. Whether it’s a small, niche item or a massive global market, tokenization unlocks new opportunities for creators, entrepreneurs, and investors.

Anything of value can be tokenized, traded, and owned. The boundaries between the physical and digital worlds are blurring, and the distinctions between asset classes are dissolving. I have researched a total of 50 different categories of assets that can be tokenized. Here are just the top 20:

The key takeaway from this section is that anybody can tokenize anything of any size or value for trade anywhere in the world. Or, it could be tokenized, programmed, monitored, and censored by 3rd parties. Either way, tokenization is here.

Key takeaways:

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

- Our assets and transactions, now digitized and stored in fragile databases managed by corrupt intermediaries, are vulnerable to loss, theft, and manipulation, highlighting the risks and inefficiencies of our current digital system.

- Tokenization allows secure, peer-to-peer asset transactions without middlemen and risks third-party surveillance and control.

The Tokenization of Money

The cornerstone of “You will own nothing and be happy” involves technocrats seizing control over the means of exchange for goods and services. Building on the types of tokens described in the previous section, I want to divide money tokenization into two sections: money issued by central banks/governments and money separated from the state. From there, we will look at each of their attributes.

This table provides an overview of the types of tokenized money:

At the outset, it is essential to state that most people worry about programmable, tokenized money, which exists in the form of CBDCs and bank-issued stablecoins.

As we discussed earlier, our current dollar (mainly used today in digital form) can already be monitored and censored – a considerable perceived concern for those worrying about CBDCs. However, CBDCs and bank-issued stablecoins both have the potential to add the following dystopian features:

- Total Control through Programmable Money: CBDCs would empower governments to dictate how you spend your hard-earned money, censoring transactions at will. Imagine being denied access to books critical of those in power or having your transactions monitored like a prisoner in a digital gulag.

- Expiration Dates: The idea that CBDCs could impose expiry dates on your money is another frightening reality. Your savings could vanish into thin air if you don’t spend it within a specific timeframe, leaving you powerless and vulnerable.

- The surveillance aspect of CBDCs is equally chilling. Those in power would track, record, and analyze every transaction, eroding any vestige of financial privacy. The thought of governments knowing your every purchase, from coffee to groceries, is enough to send shivers down the spine of anyone who values freedom.

- Negative interest rates are another potential nightmare scenario. Governments could confiscate a portion of your savings regularly, discouraging you from saving and encouraging reckless spending. These negative rates would lead to economic instability and further erosion of our financial sovereignty.

- Gateway to tyranny: But it doesn’t stop there. CBDCs are designed to be integrated with social credit systems, digital IDs, vaccine passports, and even tied to our other non-monetary assets (homes, cars, stocks, bonds), creating a complete control grid over everything we think we own. Complete digital control is the ultimate goal of technocrats: a global currency backed by energy credits, with a social credit system enforcing compliance with the UN’s 2030 Agenda.

At the outset, it is essential to note that there are more CBDC accounts globally than decentralized crypto accounts. In 2020, 35 countries were mainly in the research phase of CBDCs (except China). Today, there are 134 countries at various stages of researching, piloting, and rolling out CBDCs, representing 98% of the global GDP. You can track the real-time developments of CBDCs through the Atlantic Council’s website. Eleven countries have already rolled out CBDCs (although eight in the Eastern Caribbean have moved back to the pilot phase to work out some kinks in their systems).

As I outline in my book, The Final Countdown: Crypto, Gold, Silver, and the People’s Last Stand Against Tyranny by Central Bank Digital Currencies, there is an end goal to all of this. The ultimate plan is to connect all CBDCs and digital assets on a shared ledger that can be tracked, programmed, and censored, and for an ultimate convergence to a single global digital currency backed by energy credits.

The technocracy movement, which started in the 1930s and picked up steam in the early 1970s with the formation of the Trilateral Commission by David Rockefeller and Zbigniew Brzezinski, has dreamed of flipping the global economy from a price-based system to an energy-credit-based system.

If this sounds far-fetched, I want to introduce you to the Doconomy MasterCard, a credit card co-sponsored by the United Nations through its Climate Action Sustainable Development Goal (SDG), SDG 13—Climate Action. This MasterCard tracks your carbon usage; your card shuts off when you hit a specific limit.

MasterCard has brought together 150 major corporations, including banks like Barclays and HSBC, retailers like Saks Fifth Avenue and L.L.Bean, and airlines like American and Emirates to track and monitor the carbon footprint of our daily activities. The goal is to measure the environmental impact of every transaction, purchase, and action. This means that airlines will calculate the emissions from their flights, and sports organizations like the PGA Tour and Major League Baseball will assess the carbon footprint of their events. The idea is to hold companies and individuals accountable for their environmental impact, but it also raises concerns about the level of surveillance and control over our daily lives.

But let’s be clear: this initiative is not just about companies being socially responsible. It’s a new system of tracking and monitoring our carbon footprint, which could have severe implications for our freedoms. If this trend continues, we may soon face a world where every financial transaction is scrutinized for its environmental impact. This tracking could lead to a situation where we must conform to strict environmental standards with little control over our economic choices. The question is, do we want to live in a world where environmental authorities monitor and judge our every move?

I can’t state this clearly enough—for years, MasterCard has been working with large multinational corporations around the globe to track carbon, tie it to financial transactions, and halt the use of money when certain thresholds are met. This energy-credit-based system is the basis for complete digital tyranny and is the endgame of CBDCs.

We won’t get to a global energy-credit-based system in one step, and we won’t give up all of our assets in one step either – they will use salami tactics – slice by slice. It is a 3-step process:

- Each nation will create a CBDC (or bank-issued stablecoin) linked to a ledger, with all other assets tokenized on the same platform.

- These nation-centric CBDC/asset ledgers will interoperate with other countries’ CBDC/asset ledgers, creating one global ledger for all assets and CBDCs.

- The CBDCs will convert to being backed by energy credits and tied into a global social credit system (like the UN Agenda 2030 17 SDGs) where behavior is rewarded or punished based on how behavior impacts energy usage.

Given the current presidential race, there has been much talk about CBDCs in the US. It is current policy under President Biden, through Executive Order 14067, to pursue a CBDC while taking a whole-of-government approach to regulating digital assets. In February, Trump came out strongly against CBDCs (which I had a tiny part of, as discussed in this Zero Hedge article), which he reiterated at the Bitcoin Conference in Nashville in late July. RFK, Jr. has also said he is against CBDCs.

Unfortunately, this has engendered a highly misplaced sense of complacency in many.

Under the Biden approach (which, at this point, will also be the Kamala Harris approach), we will get a CBDC likely similar to what has been piloted through Project Hamilton. Project Hamilton, a collaboration between the Federal Reserve Bank of Boston and MIT’s Digital Currency Initiative, represents a significant step towards implementing a US Central Bank Digital Currency. This initiative has successfully demonstrated the technical feasibility of a digital dollar, with its prototype capable of processing an impressive 1.7 million transactions per second. This high-speed transaction capability suggests that the technology is ready for deployment and could replace traditional cash systems.

The other way we get a CBDC is through bank-issued stablecoins. Based on our description of token types above, CBDCs and bank-issued stablecoins are closed systems with limited access, private operations, and centralized control. To be clear, the Republicans in the House have put together bills that would give regulated financial institutions the exclusive right to issue stablecoins. While it isn’t technically a central bank digital currency, since the banks own the central bank, in the end, it is a distinction without a difference because it will still enable all of the programmability and digital tyranny features expected from a CBDC.

We have discussed the tyranny side of tokenized money, but what of the alternatives? There are over 20,000 different cryptocurrencies; as I like to say, it’s the 99% that make the other 1% look bad. Nevertheless, there are various alternatives in the form of open systems, transparent gated systems, and privacy-focused open systems (as outlined in the table at the beginning of this section).

I will expand on the explanation of these categories, give specific examples, and then weigh the pros and cons of each.

Open Systems

Open Systems, exemplified by Bitcoin, are the pioneers of decentralized cryptocurrencies. These systems operate on a universal, permissionless network, allowing anyone to participate, verify transactions, and hold a copy of the blockchain.

Bitcoin transactions are pseudonymous, not anonymous. While users are identified by wallet addresses rather than names, these addresses can be linked to real-world identities through advanced chain analysis and AI techniques. Companies and government agencies use sophisticated tools to analyze blockchain data, track transaction patterns, and correlate this information with external data sources like exchange records and social media.

This analysis allows for the de-anonymization of users, cluster analysis of related addresses, and tracing fund flows across multiple transactions. As these technologies continue to advance, it’s becoming increasingly possible to identify the individuals behind Bitcoin and Ethereum transactions, eliminating practical anonymity on these networks. Users should know that their cryptocurrency activities may be more traceable and linkable to their real-world identities than expected—many people in prison today, including friends of mine, whose assets were identified using these methods through civil asset forfeiture laws.

The so-called Bitcoin Strategic Reserve that Trump announced at a recent Bitcoin Nashville conference would be built on coins seized through civil asset forfeiture, which raises fundamental questions about the fungibility of Bitcoin. Fungibility is a fundamental property of money that ensures that all currency units are interchangeable and of equal value. In other words, if you lend someone a $10 bill, it doesn’t matter which specific bill you give them – any $10 bill will do.

However, Bitcoin’s ability to be traced and identified through its blockchain means that not all Bitcoins are created equal. Suppose a Bitcoin has been seized through civil asset forfeiture or associated with a particular user or activity. In that case, it can be flagged and potentially whitelisted or blacklisted in the future. The ability to classify BTC into categories by address means that some Bitcoins may be treated differently, undermining their fungibility. As a result, Bitcoin fails to meet critical criteria for a reliable and trustworthy currency. Without fungibility, a currency’s value and utility are compromised, making it less useful for everyday transactions and more vulnerable to manipulation and control.

The grubby paws of state surveillance now sully Bitcoin’s promise. In recent weeks, Peter Thiel, Tucker Carlson, and Edward Snowden, the most fastidious of whistleblowers, have all sounded the tocsin: the lack of privacy in Bitcoin transactions is an affront to the very ethos of decentralization.

Transparent Gated Systems (Private Stable Coins): A Compromise on Freedom

Transparent Gated Systems, such as USDC and USDT (Tether), attempt to balance decentralization with regulatory compliance. However, this compromise comes at the cost of reduced financial freedom. These systems have key characteristics that set them apart from other currencies.

They are designed to be more accessible and user-friendly, but this comes with trade-offs. For example, participation in the network may be limited to approved entities or require specific permissions, creating barriers to entry. The level of centralization is relatively high, which can impact security and censorship resistance. Additionally, Transparent Gated Systems often engage with regulatory bodies and implement Anti-Money Laundering (AML) and Know-Your-Customer (KYC) procedures, increasing the risk of government surveillance.

One of the main concerns with Transparent Gated Systems is the lack of decentralization. They are often controlled by a single company or organization, which means that users’ money could be in trouble if something goes wrong with that company. This is because the currency’s value is tied to the value of a traditional currency, such as the US dollar.

Furthermore, Transparent Gated Systems are vulnerable to various risks, including:

- Technical problems: The computer code that makes these coins work can be flawed or hacked, risking users’ money.

- Lack of transparency: The company behind the coin might not be honest about how much money it really has, making it difficult for users to trust it.

- Centralization: With private stablecoins, there’s one single point of failure. Users’ money is at risk if the company goes bankrupt or gets hacked.

- Government surveillance: Because a single company controls these coins, governments can more easily track what users do with their money.

- Counterparty risks: If the company backing the coin goes out of business, users could lose their money.

- Liquidity risks: If many people try to withdraw their money from the coin at the same time, it could cause problems.

- Market risks: Even though these coins are supposed to be stable, they can still be affected by market fluctuations.

While Transparent Gated Systems may offer some benefits, such as faster transaction times and lower fees, these benefits come with significant risks.

Ultimately, Transparent Gated Systems represent a compromise between freedom and control. They occupy a middle ground between traditional and decentralized, secure currencies like Bitcoin. However, this middle ground comes with significant trade-offs, and users must be cautious when using these systems.

Privacy-Focused Open Systems: The Guardians of Anonymity*

Privacy-focused open Systems, such as Zano, Monero, Zcash, and Pirate Chain (ARRR), are designed to protect user anonymity and confidentiality. These systems utilize advanced cryptographic techniques to conceal transaction details and participant identities, ensuring high privacy.

Another important point of differentiation exists within the realm of privacy-focused coins. Privacy coins that are private by default require no extra effort on the user’s part to remain private (Zano, Monero, and Zcash fit this description). Other coins, like Bitcoin Cash (which uses something called CashFusion) and Litecoin (which uses a technology called MimbleWimble), can optionally offer privacy. Still, it requires extra steps on the part of the user.

The benefits of Privacy-Focused Open Systems are clear. They offer robust user anonymity and confidentiality protection, making them an attractive option for those seeking to maintain their financial freedom. However, there are also potential drawbacks to consider. The complex cryptography can make these systems more vulnerable to security risks, and the smaller network size can impact decentralization.

Despite these challenges, Privacy-Focused Open Systems represent a crucial step toward creating a more private and resilient financial ecosystem. We can build a system that values individual autonomy and peer-to-peer trade by prioritizing decentralization, anonymity, and financial freedom. Ultimately, this approach can transform our thoughts about money and financial transactions and create a more equitable and just economic system.

We need not get stuck with dystopian, centralized, closed systems like those offered by CBDCs and bank-issue stablecoins. There are alternatives out there. However, open systems like Bitcoin (BTC) have proven to be too transparent for their own good and have become a form of surveillance coin.

While private stablecoins appear to improve our current digital fiat system, they involve so many intermediaries and points of failure that they undermine their use case and are highly subject to regulation.

In the end, our best path forward to stopping digital tyranny through CBDCs and bank-issued stable coins is through privacy coins and tokens like Zano, Monero, and the other coins mentioned above. At this point, all we’ve discussed is tokenized money—we haven’t even begun exploring the other 95% of the $1.5 quadrillion asset market that will be tokenized.

Tokenized money can empower individuals with decentralized, peer-to-peer transactions, promoting privacy and autonomy, or enable centralized control and surveillance through CBDCs and bank-issued stablecoins.

Key Takeaways

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

- Our assets and transactions, now digitized and stored in fragile databases managed by corrupt intermediaries, are vulnerable to loss, theft, and manipulation, highlighting the risks and inefficiencies of our current digital system.

- Tokenization allows secure, peer-to-peer asset transactions without middlemen and risks third-party surveillance and control.

- Tokenized money can empower individuals with decentralized, peer-to-peer transactions, promoting privacy and autonomy, or enable centralized control and surveillance through CBDCs and bank-issued stablecoins.

The Great Taking

Money represents only 5% of total global assets. Most of the rest will ultimately be tokenized as well. However, rather than go straight to comparing and contrasting the technical options for other asset tokenization, I offer a brief interlude to share a frightful bit of news about developments related to the tokenization of stocks, bonds, and other financial instruments that might be the single most significant catalyst to fulfilling Klaus Schwab’s “You will own nothing” agenda.

David Rogers Webb is a former highly successful hedge-fund manager and author who has exposed the most significant financial heist of our time in his book The Great Taking. For several months, I’ve reached Webb’s work and collaborated with people to help spread the word about what he’s uncovered. You can watch the video and read the book for free.

As our current financial system begins to show signs of stress, I am seeing people share clips from movies about the 2008 crisis, such as The Big Short and Margin Call. Imagine if you could watch/read about the next collapse and its aftermath BEFORE it actually happened and take steps to protect yourself. That’s how important I believe this material is.

Webb’s meticulous research reveals how, in the aftermath of the 2008 collapse, these financial overlords colluded to quietly rewrite the laws of all 50 states, effectively rigging the system to ensure that when the subsequent great financial collapse occurs, the spoils will be theirs for the taking. The targets of this insidious plan? Your stocks, bonds, 401(k)s, and retirement accounts – the very foundations of middle-class security.

Here’s how it will play out: when the next collapse comes, the largest banks, now positioned as secured creditors, will swoop in to claim ownership of these assets through bankruptcy proceedings. It’s a cleverly designed trap that will leave millions of Americans with nothing but the faint memory of a nest egg they once thought was their own.

Webb’s exposé makes it clear that this is no accident but a deliberate, calculated move to consolidate wealth and power in the hands of the few. The ‘Great Taking’ is not just a clever title; it’s a stark warning of the most significant transfer of wealth in history, leaving most Americans with nothing but the shirts on their backs.

Let’s begin with the basics. When you “buy” stocks (publicly through a 401K and using a broker), you don’t receive the actual stock certificates or have direct ownership rights. Instead, your broker holds them in “street name,” and there are multiple layers of intermediaries between you and the actual stock. The Depository Trust Company (DTC) and its nominee, Cede & Co., own most shares, with your broker and other financial institutions holding mere electronic records of your “beneficial ownership.” This “indirect holding” system is a labyrinthine construct designed to make trading more efficient, which also means you don’t own your stocks directly.

To make this point even more precise, in 2012, when Hurricane Sandy hit New York, one of DTCC’s vaults housing these stock certificates flooded, soaking 1.3 million. That single vault held paper stock certificates valued at over $39 trillion!

The DTCC vault was flooded in 2012 – soaking 1.3 million stock certificates. Note: This is not an actual picture but added to show how centralized our stocks are and that we don’t own the shares.

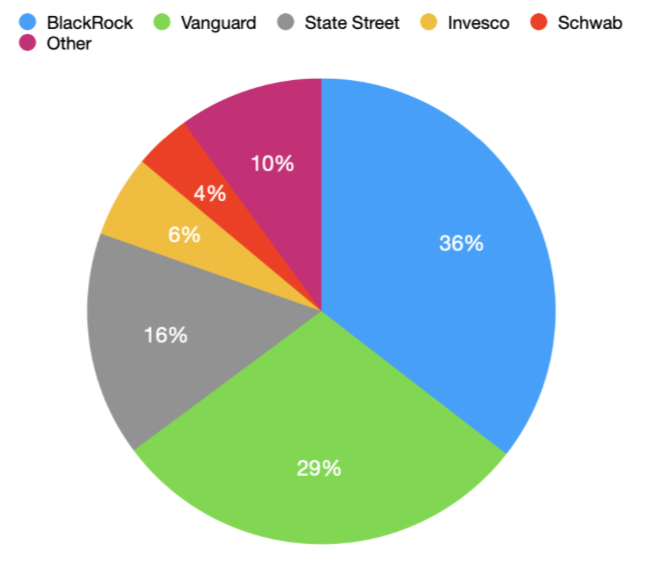

But that’s not all. Large institutional investors like BlackRock, Vanguard, and State Street, who manage massive index funds and ETFs, have voting rights for the shares they hold, giving them influence over company decisions, even though individual investors technically own the underlying shares. And suppose you think that’s not enough. In that case, many brokerages engage in practices like securities lending, where they can lend out “your” shares to short sellers for a profit, often without your knowledge or any benefit to you.

So, when you see charts like this showing that BlackRock, Vanguard, and State Street own everything, the irony is that our stocks are purchased with the money we think we own that we’ve given them voting rights to. And, in a great financial collapse, secured creditors (like JP Morgan Chase, Bank of America, Wells Fargo, and Citigroup) will own our stocks through bankruptcy!

Now, you may be thinking, “What’s the big deal? I still get my dividends and can sell my stocks whenever possible.” But, my friends, that’s precisely the point. You don’t own the stocks; you own a right to the value and benefits of those stocks. And in a financial crisis, this could complicate who owns what.

This, my friends, is the Great Taking – a potential massive transfer of wealth legally enabled by changes most people are unaware of. It’s a stark reminder that the very foundations of our financial system are designed to protect the interests of large institutions at the expense of individual investors. You don’t own your investments; you merely have a contractual claim against a system rigged against you.

Here’s the even more worrisome development. Wall Street is working with the central banks and others to develop a system for tokenizing these stocks and bonds on the same platform as CBDCs. Once this is done, The Great Taking could happen with the click of a mouse button. Everything will be tokenized; the default tokenization is through a closed system, and we have to begin looking for alternatives before it is too late.

Key Takeaways

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

- Our assets and transactions, now digitized and stored in fragile databases managed by corrupt intermediaries, are vulnerable to loss, theft, and manipulation, highlighting the risks and inefficiencies of our current digital system.

- Tokenization allows secure, peer-to-peer asset transactions without middlemen and risks third-party surveillance and control.

- Tokenized money can empower individuals with decentralized, peer-to-peer transactions, promoting privacy and autonomy, or enable centralized control and surveillance through CBDCs and bank-issued stablecoins.

- The tokenization of financial assets, driven by changes in laws and economic systems, risks enabling a massive wealth transfer to large banks and institutions, leaving individual investors with mere contractual claims rather than actual ownership.

- Similar to tokenized money, tokenizing assets poses a significant risk of centralization and control, potentially leading to the confiscation of assets by authorities through centralized platforms like the Regulated Liability Network (RLN). Alternatives exist to promote decentralization and autonomy. The RLN is a catalyst for The Great Taking.

Tokenizing Other Assets

So, there you have it. Legally, you don’t own your stocks, bonds, and 401Ks. Just like with our privacy and data ownership, we have given away our ownership in our retirement investment vehicles, in this case, through click-wrap agreements and strategic changes made by the incumbent financial services industry through changes in the UCC laws in all 50 states.

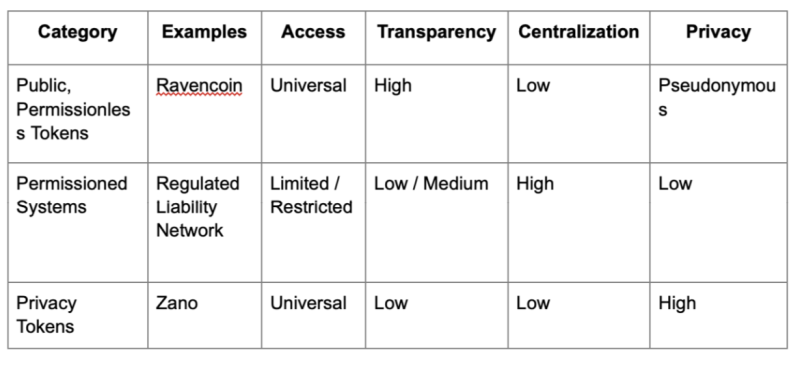

The tyranny versus freedom aspects of tokenizing money, described in the previous section, apply to tokenizing all other assets as well.

Let’s start with the bad news first. Just as the growth of CBDCs has dwarfed the development of decentralized cryptocurrencies, it appears that all of the momentum is now on the dystopian command and control side of the tokenization of other assets. Generally, tokenized assets through the CBDC system will use the Transparent Gated System type.

Transparent Gated Systems (Permissioned Systems)

Transparent Gated Systems, such as the Regulated Liability Network (RLN), attempt to balance decentralization with regulatory compliance. However, this compromise comes at the cost of reduced financial freedom. Key characteristics include:

- Limited Access: Participation in the network may be limited to approved entities or require specific permissions, creating barriers to entry.

- High Centralization: These systems are often controlled by a single company or organization, increasing the risk of security and censorship issues.

- Regulatory Compliance: Transparent Gated Systems often engage with regulatory bodies and implement Anti-Money Laundering (AML) and Know-Your-Customer (KYC) procedures, increasing the risk of government surveillance.

What is a Regulated Liability Network (RLN)?

The Regulated Liability Network (RLN) is a proposed global financial infrastructure that aims to digitize and connect various forms of money and assets across countries. Here’s an explanation for a general audience:

What is the RLN?

The RLN is envisioned as a shared digital platform where central banks, commercial banks, and other regulated financial institutions can issue, transfer, and settle digital versions of traditional financial assets. This platform includes central bank digital currencies (CBDCs), tokenized bank deposits, government bonds, stocks, and potentially even regulated versions of cryptocurrencies and stablecoins (imagine having to register Bitcoin, Ethereum, and your other cryptos on a centralized system).

How it works:

1. Digital tokens: Financial assets are represented as digital tokens on the network. These are permissioned tokens, as per the table above.

2. Multiple oversight: Authorized parties, including central banks, financial regulators, and law enforcement agencies, can monitor, track, and potentially censor these tokens.

3. Asset registration: An asset must be registered and approved for trading on the RLN. This registration applies to stocks, bonds, stablecoins, and potentially other cryptocurrencies.

4. KYC/AML implications: The system would require strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Every participant and transaction would be identifiable, eliminating anonymity.

5. Global connectivity: Different countries’ CBDCs and financial systems would connect to the RLN, creating a global digital asset and money platform.

Key players behind the RLN:

- – MIT (research and development)

- – Federal Reserve Bank of New York (central bank involvement)

- – Bank for International Settlements (BIS) (international coordination)

- – Depository Trust & Clearing Corporation (DTCC) (financial market infrastructure expertise)

- – Large global banks (as potential participants and developers)

Relation to “The Great Taking:”

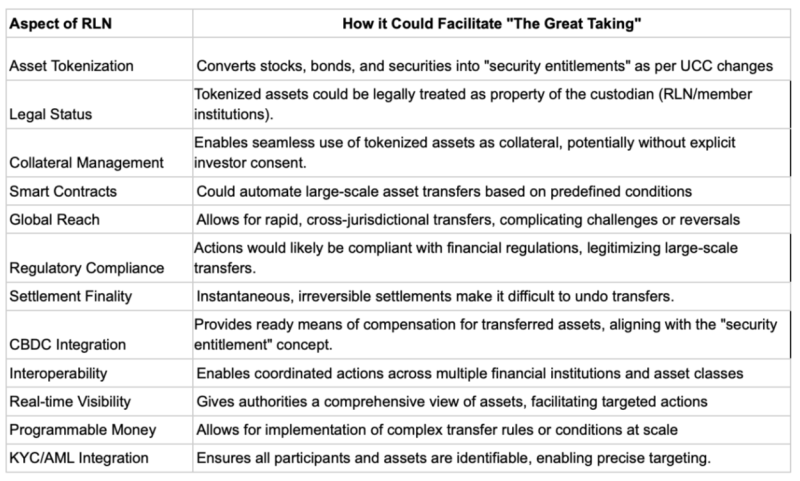

The RLN is the missing piece that could facilitate large-scale asset transfers or seizures due to its comprehensive nature and the level of control it offers to authorities. Here’s a table illustrating how the RLN might relate to aspects of “The Great Taking:”

I know that this table has a lot of technical jargon, so let me simplify the explanation:

The Regulated Liability Network (RLN) is the ultimate tool for the wholesale theft of our assets. Imagine a world where all your financial assets are neatly tokenized and stored on a centralized platform, just waiting to be “reallocated” by the benevolent authorities. And don’t worry; it’s all legitimate because the RLN is designed to comply with all the relevant financial regulations.

It’s like a digital version of the Reichstag Fire Decree, where the government can seize control of all assets in the name of “national security.” Your stocks, bonds, and securities are converted into “security entitlements,” which can be easily confiscated by the powers that be. And don’t even think about trying to hide your assets because the RLN has real-time visibility into all transactions, ensuring that no one can escape the all-seeing eye of the authorities.

The RLN also has smart contracts, which can automate large-scale asset transfers based on predefined conditions. It’s like a digital version of the Soviet Union’s forced collectivization, where the state can seize control of all assets in the name of “the greater good.” By integrating the RLN and Central Bank Digital Currencies (CBDCs), the authorities can compensate you for confiscating assets using their digital funny money.

This is the essence of the RLN, stripped of its technical jargon and presented in all its Orwellian glory. The table may spell out the details in dry, technical terms, but the end result is the same: a system designed to facilitate the massive confiscation of assets under the guise of “regulation” and “compliance.”

And just like that, You will own nothing, but I am certain you won’t be happy.

Just as there are categories of alternatives to CBDCs, there are also alternatives to centralized, dystopian asset tokenization. We will review them now.

Key Takeaways

- We have unknowingly given away most of our rights through countless digital agreements we sign without reading, eroding personal ownership and autonomy and making our assets vulnerable to corporate control.

- Our assets and transactions, now digitized and stored in fragile databases managed by corrupt intermed