Universal Basic Income – Tried, Tested, And Failed As Expected

Authored by Lance Roberts via RealInvestmentAdvice.com

Authored by Lance Roberts via RealInvestmentAdvice.com

A Universal Basic Income (UBI) sounds great in theory. According to a previous study by the Roosevelt Institute, it could permanently increase the U.S. economy by trillions of dollars. While such socialistic policies sound great in theory, history, and data, they aren’t the economic saviors they are touted to be.

What Is A Universal Basic Income (UBI)

To understand why the theory of universal basic income (UBI) is heavily flawed, we need to understand what UBI is.

“Basic income, also called universal basic income (UBI), is a public governmental program for a periodic payment delivered to all citizens of a given population without a means test or work requirement. Basic income can be implemented nationally, regionally, or locally, and is an unconditional income sufficient to meet a person’s basic needs (i.e., at or above the poverty line).“

The idea of guaranteed income is not a new thing. According to Wikipedia:

“The concept of a state-run basic income dates back to the early 16th century when Sir Thomas More’s “Utopia” depicted a society where every person receives a guaranteed income.

In the late 18th century, English radical Thomas Spence, and American revolutionary Thomas Paine, declared their support for a welfare system that guaranteed an assured basic income. Nineteenth-century debate on basic income was limited, but during the early part of the 20th century, a basic income called a “state bonus” was widely discussed.

In 1946, the United Kingdom implemented unconditional family allowances for every family’s second and subsequent children. In the 1960s and 1970s, the United States and Canada conducted several experiments with negative income taxation, a related welfare system. From the 1980s and onward, the debate in Europe took off more broadly, and since then, it has expanded to many countries around the world. “

While the concept of a UBI sounds good in theory, do they work in reality?

Will UBI Won’t Increase Economic Growth

“More money in people’s pockets will lead to stronger economic growth.” – J.M. Keynes

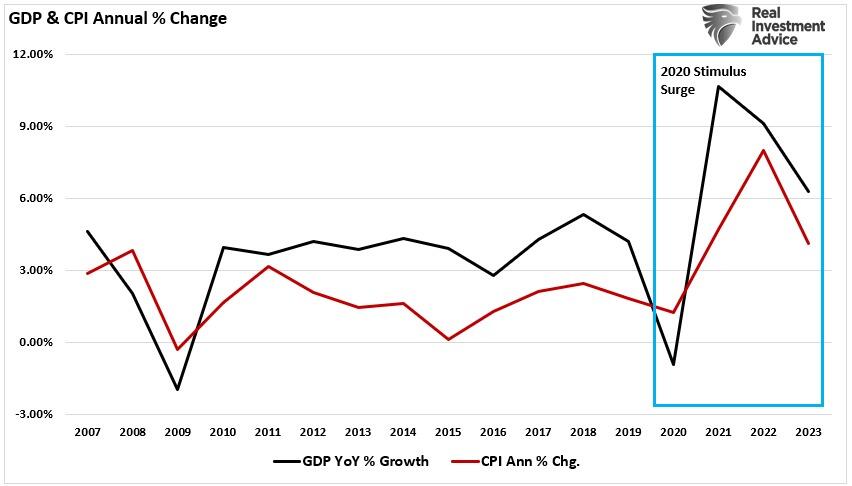

The underlying sentiment behind a universal basic income is that if the government provides a base income, it will lead to more robust economic growth. In 2020 and again in 2021, the U.S. Government implemented a limited form of UBI by sending $1400 checks to households. The result was unsurprising. While those checks did lead to strong economic growth, they also created a surge in inflation, essentially wiping out the stimulus’s benefit.

As shown, the stimulus surge led to an increase in economic activity. However, the impact on the quality of life (due to the rise of inflation) was minimal, if not negative. Those stimulus payments were not true UBIs, as each payment only occurred once. A true UBI is a monthly income provided.

While the Roosevelt Institute suggested that UBI was an economic savior, the other point they missed was that the UBI would only provide benefits for a single year.

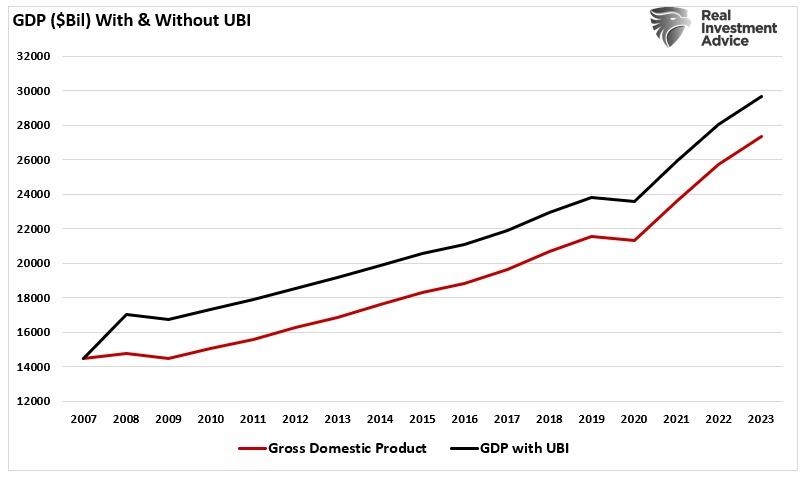

Let’s run a hypothetical example using GDP from 2007 to the present. We will assume that In 2008, in response to the “Financial Crisis,” Congress passed a bill providing $1000/month ($12,000 annually) to 190 million families in the U.S.

The chart below shows the economy’s annual GDP growth trend, assuming the entire UBI program contributes to economic growth. For those supporting programs like UBI, it certainly appears as if GDP is permanently elevated to a higher level.

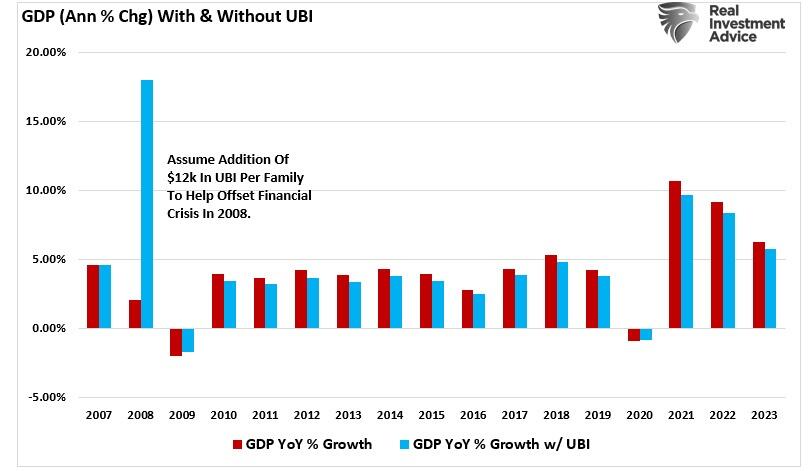

However, such is a bit deceiving. When we examine the annual rate of change in economic growth, which is how we measure GDP for economic purposes, a different picture emerges. In 2008, when the initial $12,000 arrived at households, GDP spiked, printing a 17% growth rate versus the actual 1.81% rate. Such would be expected as consumers spend the additional income. (The spike in GDP In 2021 was due to the stimulus payments during the Pandemic.)

However, beginning in 2009, the benefit disappears. That is because following the injection of UBI into the system, the economy normalizes to a new level after the first year. Also, notice that GDP grows slightly slower as the dollar changes to GDP at higher levels print a lower growth rate. Furthermore, the increase in demand from providing a UBI will be offset by the rise in inflation, just as we saw in 2021.

A good example was the Biden Administration’s increase in childcare benefits. While households received more benefits to pay for childcare, the cost of childcare rose faster than the benefit, making childcare even more unaffordable.

Economic basics are nearly always forgotten in a rush to help those in need. If incomes are increased by $1000/month, prices of goods and services will adjust to the increased demand. The economy will quickly absorb the increased incomes, erasing the proposed UBI benefit.

UBI’s Dark Side

Of course, the money to provide the $12,000 UBI benefit had to come from somewhere.

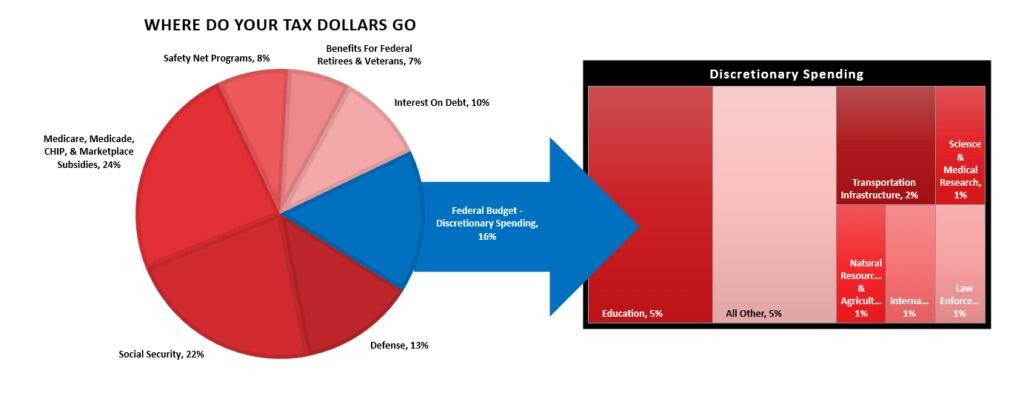

According to the Center On Budget & Policy Priorities, in 2023, roughly 90% of every tax dollar went to non-productive spending.

“In fiscal year 2023, the federal government spent $6.1 trillion, amounting to 22.7 percent of the nation’s gross domestic product (GDP). About nine-tenths of the total went toward federal programs; the remainder went toward interest payments on the federal debt. Of that $6.1 trillion, only $4.4 trillion was financed by federal revenues. The remaining amount was financed by borrowing.”

Think about that for a minute. In 2023, 90% of all expenditures went to social welfare, non-productive spending, and interest on the debt. Those payments required $6.1 trillion, roughly 138% more than the tax dollars collected.

Given the decline in economic activity this year, those numbers will likely become markedly worse. Given this data, it would also mean that 100% of the UBI payments would have come solely from debt.

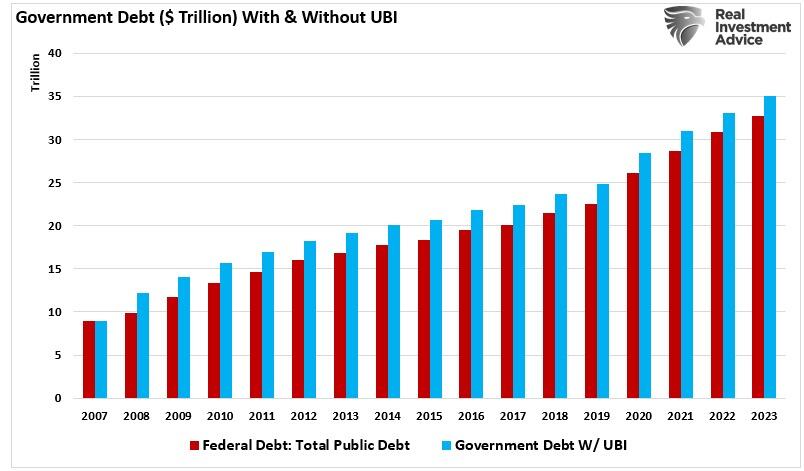

The table below shows the increase in total Federal Debt adjusting for the annual UBI payment.

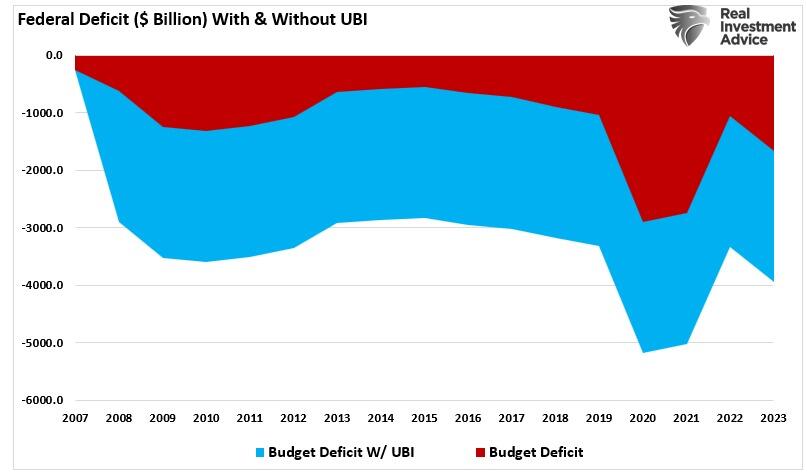

The chart below takes our hypothetical example and compares the impact of the additional debt on the Federal deficit from the implementation of UBI.

While the “theoretical models” assume that UBI will create enough economic growth and prosperity to “offset” the increase in debt, 40-years of history suggest otherwise.

However, this is all theory about the impact of UBI on economic prosperity. A recent 3-year study provides the actual results.

The Results

“Five researchers published a paper that tracked 1,000 people in Illinois and Texas over three years who were given $1,000 monthly gifts from a nonprofit that funded the study. The average household income for the study’s participants was about $29,000 in 2019, so the monthly payments amounted to about a 40 percent increase in their income.”

Surely, those who received $1000/month for three years were much better off in the end? As noted by Reason:

“Relative to a control group of 2,000 people who received just $50 per month, the participants in the UBI group were less productive and no more likely to pursue better jobs or start businesses, the researchers found. They also reported “no significant effects on investments in human capital” due to the monthly payments.

Participants receiving the $1,000 monthly payments saw their income fall by about $1,500 per year (excluding the UBI payments), due to a two percentage point decrease in labor market participation and the fact that participants worked about 1.3 hours less per week than the members of the control group.”

If those people are working less, the question to ask is how they spend that extra time.

“Participants in the study generally did not use the extra time to seek new or better jobs—even though younger participants were slightly more likely to pursue additional education. There was no clear indication that the participants in the study were more likely to take the risk of starting a new business, although Vivalt points out that there was a significant uptick in “precursors” to entrepreneurialism. Instead, the largest increases were in categories that the researchers termed social and solo leisure activities.”

The results of the 3-year experiment are unsurprising, as basic economics and human nature would already surmise.

Conclusion

In its essential framework, a universal basic income sounds excellent. It would ensure that everyone has fundamental needs covered. Then, they can go out and produce and not worry about covering critical bills. Unfortunately, the additional income is quickly absorbed into the economy as prices rise (inflation) to compensate for the extra spending. After the first year, the UBI would have to be increased or no longer have any benefit.

Therein lies the trap with all socialistic programs.

While UBI, along with free healthcare, education, childcare, etc., sounds great, they are NOT productive investments with a higher return than the carrying cost of the debt. History suggests these welfare supports have a negative multiplier effect on the economy.

Most telling is the inability of the current economists, who maintain our monetary and fiscal policies, to realize the problem of trying to “cure a debt problem with more debt.”

The Keynesian view that “more money in people’s pockets” will drive up consumer spending and boost GDP has been wrong.

It hasn’t happened in 40 years.

We fear these socialistic programs, which promise “free everything” with no consequences, instead deliver inflation, generate further income inequality, and ultimately increase social instability and populism. Such has resulted in every other country running such programs with unbridled debts and deficits.

It is also showing up in the United States as well.

While UBI sounds excellent at the conversational level, so does “communism” and “socialism.” In practice, the outcomes have been vastly different than the theory.

As Dr. Woody Brock aptly argues:

“It is truly ‘American Gridlock’ as the real crisis lies between the choices of ‘austerity’ and continued government ‘largesse.’ One choice leads to long-term economic prosperity for all; the other doesn’t.”

Take your pick.

Sourced from ZeroHedge

Top image: Truth Unmuted

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Minds, MeWe, Twitter – X and Gab.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.