Living Well on Less Than $30,000 a Year–One American Family’s Story

“It’s all because of our low cost of living that I can feel relatively secure.”

We see stories like this all the time: Survey: The average American feels they need to earn over $186,000 a year just to live comfortably.

This is over three times the $59,000 median annual earnings of full-time workers in the US (52 weeks X $1,139). Median weekly earnings of the nation’s 119.2 million full-time wage and salary workers were $1,139 in the first quarter of 2024 (not seasonally adjusted), the U.S. Bureau of Labor Statistics reported. (Source: BLS).

This is more than double the median household income of $74,580.

According to this site, about 13% of US households earn $186,000 or more per year. Other sources say the top 10% of US households have an income threshold of $191,406, while the top 5% have an income threshold of $290,164. These numbers vary widely state by state, with high-cost / high-income states having much higher thresholds than lower-cost states.

Bottom line, the bottom 90% say they need a top 10% income to feel secure financially. According to the survey, to feel rich, the average American feels they need to earn $520,000 a year–a top 2% income.

All of the above represents the conventional view that financial security requires being wealthy. The alternative view is financial security results from a low-cost, low-consumption, no-debt lifestyle of the kind I outlined in Is It Possible to Live Well Earning $30,000 a Year in America? Yes–With These Conditions (July 3, 2024).

To state the obvious: it’s easier to live on less than it is to earn big bucks.

Confirming that it is possible to live well on less than $30,000, correspondent M.C. shared how his family lives well on a modest income. Their lifestyle and financial choices are within reach of pretty much any couple / family willing to make the required trade-offs. Yes, it can be done in inflationary America 2024, but it requires redefining “financial security” and “wealth,” and trading the insatiable desires of conspicuous consumption and the desire to live in places coveted by the wealthy for much different sources of both inner security and financial security.

The Ultimate Guide to Frugal Living: Save Money, Plan Ahead, Pay Off Debt & Live Well

The Ultimate Guide to Frugal Living: Save Money, Plan Ahead, Pay Off Debt & Live Well

Here is M.C.’s commentary:

“Yes, it’s certainly possible for a couple to live on 30k annually.

My wife and I have been doing this the past 4 years on a single $13.65 an hour job (up from $12 a few years ago) in a retail hardware store a few blocks away. (No benefits except an employee deduction on purchases.) We live in a rural area near the center of the USA.

We bought the house we are living in for 14k cash in 2011. Further, we can replace it (in our rural community with a population of 3,000 and continuing to decline) without breaking the bank (not much housing demand here).

Taxes. We pay nothing to the IRS. For 2024, the standard deduction for a two person household is $29,200. If our taxable income went over that, we can contribute to an IRA. We paid less than $200 in state income taxes last year. Our sales tax is 9%, except that unprepared food from a grocery store has just a 2% tax.

Debts. We own our house and land. We buy our vehicles for cash. I just replaced my 1997 Grand Marquis that I’ve been driving since 2006. My wife drives a 2014 that we’ve had several years and that will hopefully last several more. No debts, no credit card balances.

Healthcare. Health insurance on the ACA marketplace is free if taxable income is between 100 and 150% of the poverty level. For a couple, that’s $19,720 – $29,580 this year. If we were a bit over that upper number, then we could reduce taxable income by contributing to an IRA.

Food. We are growing tomatoes, strawberries, watermelon, cantaloupe, and green beans. The lettuce and spinach got eaten up by bugs last year, so I didn’t plant more. The corn and sunflowers didn’t work out well either. I try to stock up on groceries when they are on sale, especially the items we eat a lot.

Entertainment. I rarely ever watch television. We don’t have an XBox or any such gaming devices. Four of our seven grandkids live in town, so that’s our entertainment. We go to their ballgames, music programs, take them to movies, recreational activities (I play tennis with a couple of them).

Insurance. No property insurance except the required liability insurance on our vehicles. So we are self-insured (other than the required auto liability insurance). That’s scary to a lot of people, but we buy good used vehicles and keep them maintained. In addition, we have an added advantage of family members who are electricians, as well as the fact that we are allowed to do the work on a house that we both own and live in. So, I do my own roofing, repairs, painting, etc.

We are able to go without property insurance because we have a few years worth of living expenses saved up. We have been living on less than $30k per year, but I feel it important to be straight-forward that we have an advantage that many don’t have. We have peace of mind with retirement funds in a Roth IRA that can be used if things break or the budget gets tight. This is the first year of the four where we will draw some from retirement accounts. I don’t anticipate doing this again for another four years.

To be quite honest, we could get by on a lot less than we currently live on. We eat out more than we would if money were tighter.

I would like more people to be aware that it’s possible to live on less money. Around age 25, I had it all mapped out to becoming a millionaire. But life happened. And at some point I figured out that I wouldn’t really want to win the lottery, as it would change almost everything about my life.

We could seek more paid work but I felt we had enough money, even though we have a fraction of what most people consider to be ‘enough’ to retire. It’s all because of our low cost of living that I can feel relatively secure. I don’t have much that anyone would want to steal, so I don’t have much to worry about.

I love the mention of your building a micro-house. I’ve been working on a plan, and want to build one on our daughter’s 4 acres. And depending how that goes, I might build a couple more, starting with our son’s property.”

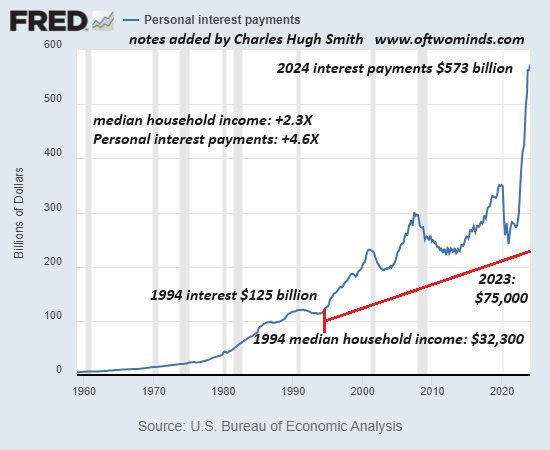

Thank you, M.C. for sharing your family’s pathway to financial security. Paying no interest / having no debt is a big part of that security:

New Podcast: 10 Geopolitical / Financial Risks to the Global Economy

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can’t Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Source: Of Two Minds

Image: Pixabay

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter – X, Gab, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.