Liberty & Inflation For All: Even Fireworks Shows Scaled Down This Year

While the cost of fireworks is down compared to last year, prices of just about everything else are way up.

That means individuals are still buying fireworks to light off themselves, but the size and scope of municipal fireworks shows are being downgraded in many towns and cities across the country – and in some areas, have been canceled entirely.

By and large, fireworks are cheaper now than a year ago, but they’re still vastly more expensive if you go back a few years farther, to pre-covid. And a reduction in demand since then hasn’t fully stifled the cost increase, especially as fireworks produced in China still need to be shipped across the ocean to American buyers.

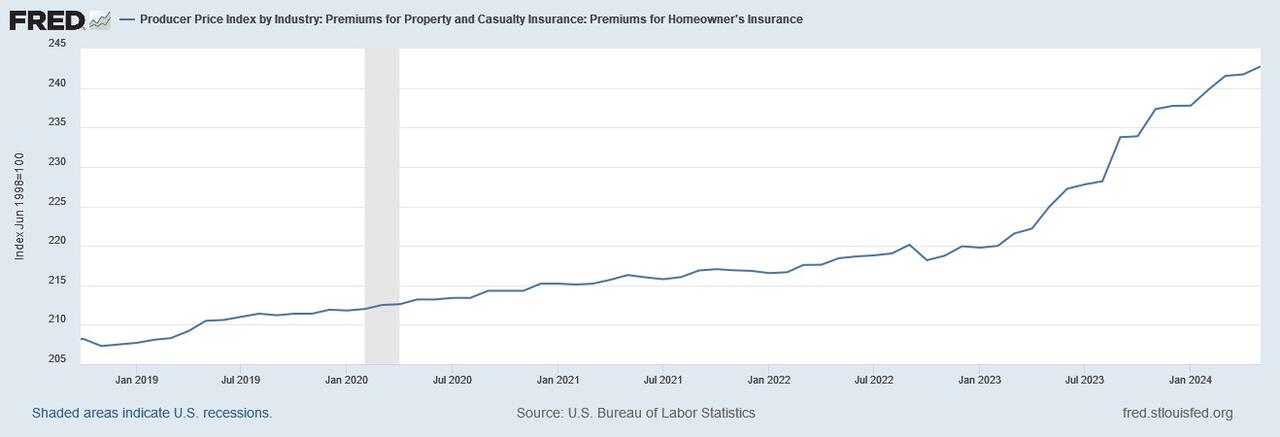

For towns and cities used to putting on extravagant displays, the costs are many. There’s a need for practical additions like portable bathrooms, shuttle buses, and trained pyrotechnicians. Some towns hire DJs to play music. But one of the largest costs is insurance, which every official fireworks display is required to have, and which has skyrocketed in cost.

Insurers know that if something goes awry and a claim is filed, the cost of dealing with it will be much higher than during previous years: fixing or replacing damage, handling medical emergencies, and planning for other externalities take much more fiat money than it did just a few years ago, and nothing is expected to change for the better. As Peter Schiff said earlier this year:

“The Fed printed an absurd quantity of money during the pandemic, and government deficits went through the roof. What has fundamentally changed since then?”

That’s even truer when you need specialized insurance coverage which has to cover a wide variety of things, as is the case for municipal fireworks shows. Towns don’t just need personal and property liability insurance to protect technicians and the public, but also insurance for transporting the fireworks, protection in case of event cancellation or inclement weather, and other aspects.

That’s why premiums for home, health, and car insurance have also gone way up, along with liability insurance and other types. Insurers know it’s going to cost way more to fix what breaks, whether it’s your home, your car, or a glitchy municipal fireworks demonstration going haywire and blowing up a public park.

Home Insurance Premiums, 2019-2024

The problem will only get worse, so expect to see even more downscaling next year, especially if Trump wins the election and imposes tariffs on Chinese imports, and further pushes up the cost of fireworks themselves.

Municipalities are going to have to deal with those higher costs and adjust their shows — and the expectations of residents — accordingly. On the bright side, your dogs and cats may get a break from all the noise. But on the downside, goods and services for Americans will be less affordable than ever before as Americans try to spend their devalued dollars.

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter – X, Gab, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.